- People

- Expertise

Our expertise

We are a team of more than 500 professionals, with the depth of experience which makes us genuine experts in our fields. Together, gunnercooke’s people have strength across just about every corporate discipline and sector. We provide legal, commercial and strategic advice that delivers real value to the clients we work with, which span from multinational enterprises through to unicorns and non-for-profit organisations. Our breadth of expertise covers some of the most interesting and important emerging disciplines, from ESG and charity law, to blockchain and competition.

Search by practice areaDispute ResolutionDispute Resolution OverviewMeet the Dispute Resolution TeamIntellectual Property DisputesFinancial Services & FinTech OverviewProceeds of CrimeEmployment TribunalTax InvestigationProperty Dispute ResolutionInsolvency DisputesMediationCivil Fraud & Asset TracingHealth & SafetyBusiness Crime & InvestigationsLitigation & ArbitrationInternational Arbitration - International

International Offices

The gunnercooke group has 15 main global offices across England, Scotland, the US, Germany and Austria, with further plans for growth in the coming years. These offices enhance the existing in-house capability of our dedicated international teams and dual-qualified experts that cover Spain, France, Italy, Portugal, Brazil, China, India, Poland and Hungary. Our team have clients across 123 jurisdictions, speak 46 languages and are dual-qualified in 21 jurisdictions. Our expertise means we can offer large teams to carry out complex cross-border matters for major international clients.

- Our story

Our story

gunnercooke is the fastest growing corporate law firm in the UK, now making its mark globally. We comprise a rapidly growing number of experts spanning legal and other disciplines. Clients benefit from flexible options on fees to suit their needs, access to a wider network of senior experts throughout the relationship, and legal advice which is complemented by an understanding of the commercial aspects of running a business.

- Reading Room

- News & Insights

In Spain each region has different tax rules and, therefore, inheriting or gifting property will have different tax implications depending on where the property is located. The truth is that those differences can be substantial and as you will see from this article, the tax amount varies depending on whether it is a lifetime gift or a transfer after death.

Quite often we come across clients who are valuing whether to gift their property in Spain to the children while they are alive rather than waiting to transfer it to them after death. In certain cases, this is because those clients are not using the property anymore, but the children are. In other cases, those clients think that this will save their beneficiaries from paying Inheritance Tax in Spain.

In this study, we are going to make a comparison between the different tax regimes that apply in some regions of Spain (called Autonomous Communities), focusing on those regions where the British (and foreigners in general) have been buying property more often: Andalusia, Balearic Islands, Canary Islands, Catalonia, Madrid and Valencia region.

We aim to show how much non-residents in Spain (in this case British but the information we provide in this article is valid for any other nationalities) must pay in taxes if they receive property after death or are recipients of a gift in Spain.

We will compare two cases for each tax using estate values of 180,000 Euro and 350,000 Euro respectively. It is important to note how different values affects tax. This is because inheritance and gift tax are calculated on a sliding scale that varies depending on the value of the assets as well as some other factors. The tax due is not a flat rate like in the UK (i.e. 40%) but based on a sliding scale.

The calculations will be based on the basis that the beneficiary is either the spouse (or civil partner) or a child over the age of 21 as they are treated in the same way for tax purposes.

Inheritance Tax

CASE SCENARIO 1: Mr. Joe Bloggs passed away with a Spanish estate worth 180,000€ that includes a property in Spain and a Spanish bank account. The beneficiary of his estate is Mrs. Bloggs, his wife. (Bear in mind that the tax due is usually the same if the beneficiaries are the children, except in the Canary Islands and Catalonia where we will point out some differences).

On the map below, you will see how those assets referred above are differently taxed. You might be surprised to see that the tax due can go from 0.00 Euro to 4,600 Euro, depending on where the assets are located.

How is this calculated?

*The tax allowances are the same that we have mentioned in CASE SCENARIO 1

ANDALUSIA

- Tax due: 0€

BALEARIC ISLANDS

- Tax due: 3,250€

CANARY ISLANDS

- Tax due by spouse/civil partner: 346.48€

- Tax due by son/daughter: 786.99€

CATALONIA

- Tax due by spouse/civil partner: 315€

- Tax due by son/daughter: 14,625.01€

COMMUNITY OF MADRID

- Tax due: 641€

VALENCIAN COMMUNITY

- Tax due: 21,564.13€

Once again, you might be surprised to see that on the same case scenario but with a larger estate, the tax rates and amounts due in those regions also vary.

Now, lets have a look to lifetime gifts:

Gift Tax

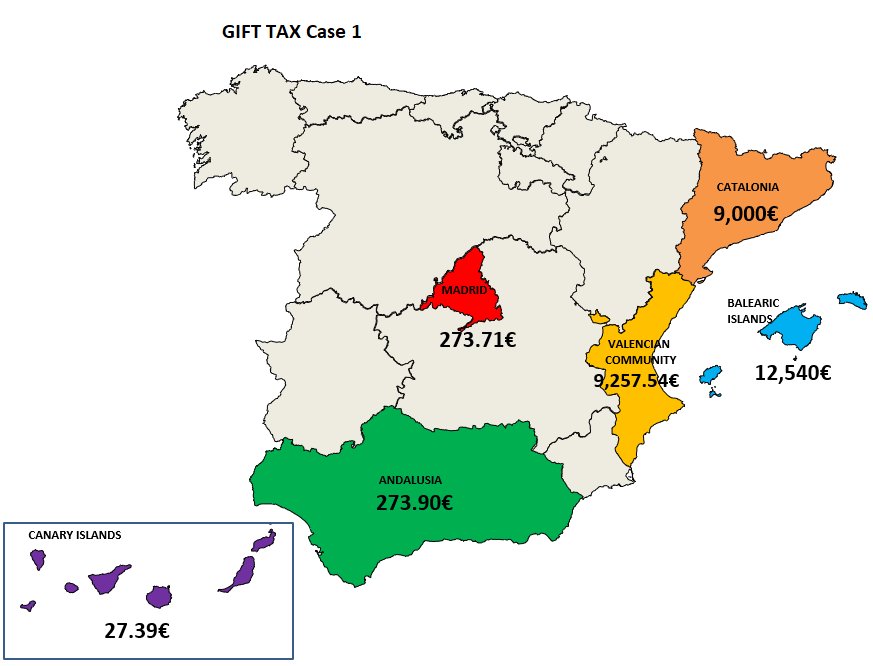

CASE SCENARIO 1: Mr. Joe Bloggs transfers by gift to his daughter or to his son his property in Spain worth 180,000€. (Bear in mind that the tax due is the same if the recipient is his wife/civil partner).

Let´s look at our map:

As you can see, one more time, the differences between regions are huge and the same case scenario in one region (same family, same assets) can be taxed more heavily by gift than by death (i.e. in Catalonia 0.00 Euro after death while 9.000 Euro by lifetime gift) while in some other regions there is not much of a difference between transferring property after death or by gift.

ANDALUSIA

Tax allowance on the tax amount due of 99%.

- Tax due: 273.90€

BALEARIC ISLANDS

Tax allowance on the tax amount due depending on the tax base.

- Tax due: 12,540€

CANARY ISLANDS

Tax allowance on the tax amount due of 99% if the amount is less than 55,000€.

- Tax due: 27.39€

CATALONIA

- Tax due: 9,000€

COMMUNITY OF MADRID

Tax allowance on the tax amount due of 99%

Tax due: 273.71

VALENCIAN COMMUNITY

Tax allowance on the tax base of 100,000 Euro if the recipient´s assets are below 600,000 Euro

- Tax due: 9,257.54€

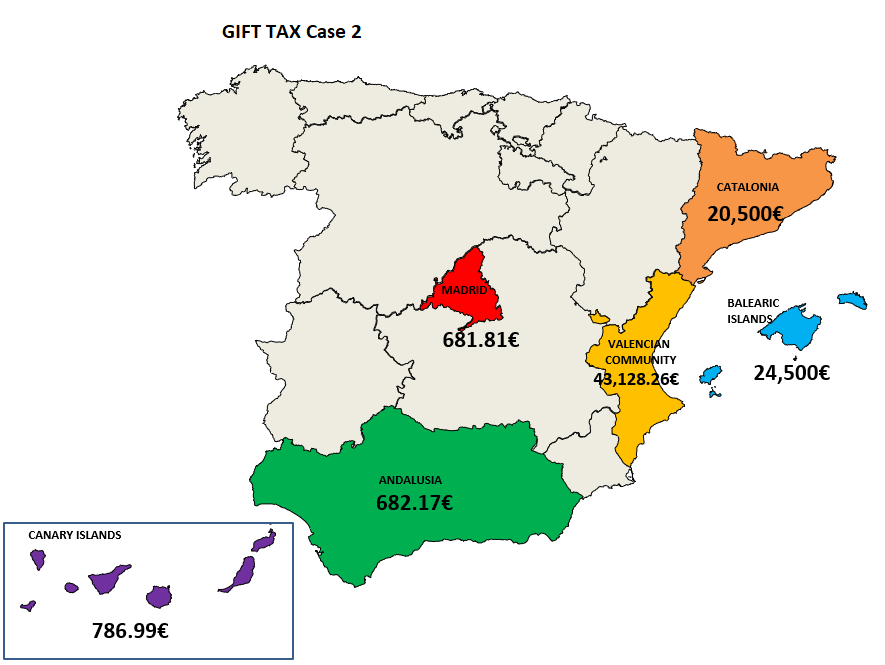

If we look at a greater value of the property that is going to be transferred, the amount of tax then increases exponentially.

CASE SCENARIO 2: Mr. Joe Bloggs transfers by gift to his daughter or son his second residence in Spain with a value of 350,000€. (Bear in mind that the tax due is the same if the recipient is his wife/civil partner).

*The tax allowances are the same that we have mentioned in CASE SCENARIO 1

ANDALUSIA

- Tax due: 682.17€

BALEARIC ISLANDS

- Tax due: 24,500€

CANARY ISLANDS

- Tax due: 786.99€

CATALONIA

- Tax due: 20,500€

COMMUNITY OF MADRID

- Tax due: 681.81€

VALENCIAN COMMUNITY

- Tax due: 43,128.26€

CONCLUSION: Taxes in Spain when transferring property might be extremely different across the Spanish territory. They vary depending on where the assets are located (or in the event of Spanish residents, where the beneficiary is a tax resident), their value, the kinship and how the property is transferred i.e. after death or by gift.

Transferring Spanish property to the children while the parents are alive can benefit the children saving them from dealing with the future estate and, therefore, prove the easiest option but it can also be much more taxable and not worth it. It is therefore paramount to study all the available options to ensure that a lifetime gift does not prove more expensive than leaving the asset on a Will. Your Spanish lawyer should be able to guide you on the best of way of transferring property in Spain to your loved ones.