- People

- Expertise

Our expertise

We are a team of more than 500 professionals, with the depth of experience which makes us genuine experts in our fields. Together, gunnercooke’s people have strength across just about every corporate discipline and sector. We provide legal, commercial and strategic advice that delivers real value to the clients we work with, which span from multinational enterprises through to unicorns and non-for-profit organisations. Our breadth of expertise covers some of the most interesting and important emerging disciplines, from ESG and charity law, to blockchain and competition.

Search by practice areaDispute ResolutionDispute Resolution OverviewMeet the Dispute Resolution TeamIntellectual Property DisputesFinancial Services & FinTech OverviewProceeds of CrimeEmployment TribunalTax InvestigationProperty Dispute ResolutionInsolvency DisputesMediationCivil Fraud & Asset TracingHealth & SafetyBusiness Crime & InvestigationsLitigation & ArbitrationInternational Arbitration - International

International Offices

The gunnercooke group has 15 main global offices across England, Scotland, the US, Germany and Austria, with further plans for growth in the coming years. These offices enhance the existing in-house capability of our dedicated international teams and dual-qualified experts that cover Spain, France, Italy, Portugal, Brazil, China, India, Poland and Hungary. Our team have clients across 123 jurisdictions, speak 46 languages and are dual-qualified in 21 jurisdictions. Our expertise means we can offer large teams to carry out complex cross-border matters for major international clients.

- Our story

Our story

gunnercooke is the fastest growing corporate law firm in the UK, now making its mark globally. We comprise a rapidly growing number of experts spanning legal and other disciplines. Clients benefit from flexible options on fees to suit their needs, access to a wider network of senior experts throughout the relationship, and legal advice which is complemented by an understanding of the commercial aspects of running a business.

- Reading Room

- News & Insights

Summary and analysis by gunnercooke marine and shipping lawyer Simon J Murfitt 麥富德

Intro

The EU ETS is a “cap-and-trade” legislative scheme by which the European Union is striving to cap certain emissions of certain greenhouse gases (“GHG”). As a result, it is one of the three relevant CO2 reporting schemes for shipping companies. The other two being the UK MRV (see below) and the IMO DCS.

The EU’s chosen method is to set a limit, or cap, on GHG emissions by an industry sector basis. The intention to require certain emitters to surrender their earlier allocated emission allowances to offset the GHGs that they are currently emit. Some limited number of emitters were granted free emission allowances, but for most allowances have had to be purchased in auctions.

The body responsible for arranging those auctions is the the European Energy Exchange (the “EEX”). It is within the EEX and its framework that such allowances may then be traded. Those allowances, traded or not, are then surrendered to the relevant national competent authority by the emitters. This approach is why the EU ETS is a “cap and trade” emissions scheme.

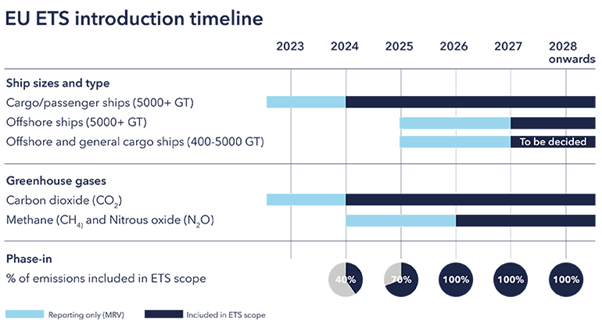

Between now and 2026, certain changes are being made to the EU ETS to include certain shipping emissions. The first step is to require phasing in requirements to report emissions and to purchase and surrender allowances for increasing proportions of carbon dioxide (CO2), nitrous oxides (N2O) and methane (CH4) emissions from shipping activity within the EU, between now and 2026.

UK System

In the UK, the scheme for monitoring, reporting and verification or “MRV” for shipping emissions came out of Brexit and has been live since the start of 2022. The relevant law is the Merchant Shipping (Monitoring, Reporting and Verification of Carbon Dioxide Emissions) (Amendment) (EU Exit) Regulations 2018 (the “UK MRV”). The UK MRV is analogous to the EU MRV (see below) with some differences, mainly related to the scope of travel and other specifics. Since that start date, all vessels calling UK ports must have a monitoring plan. Those plans then must be verified according to the UK MRV reguatiosn and then the first UK MRV emissions report is to be submitted to the relevant verifier for reporting period 2022.

How will the changes to the EU MRV affect shipping companies?

Shipping companies have been required since 2018 to report certain carbon dioxide (CO2) emissions from voyages of cargo and passenger vessels over 5,000 GT between ports within the EU, as well as emissions while in EU ports, and from voyages into or out of the EU.

It is envisaged that as of the beginning of 2024 shipping companies will likely also have to purchase and surrender emissions allowances covering 40% of their intra-EU voyage and EU port CO2 emissions in 2024, and covering 20% of emissions on voyages into or out of the EU. The percentage of CO2 emissions for which allowances need to be surrendered will increase over 2024-2026 to:-

- 100% for intra-EU voyage emissions; and

- 50% for voyages into1 or out of the EU,

Both subject to certain exceptions.

The obligations to report emissions and to surrender corresponding allowances will then expand gradually over 2024-2026 to cover emissions of nitrous oxides (N2O) and methane (CH4). Windfarm and other inshore operators should also note that the requirements to report and to surrender allowances will also be extended to vessels servicing such offshore installations over 2024-2026.

What’s the status of the EU legislation implementing these changes?

At the time of writing, there is no final or consolidated piece of draft legislation yet. The EU Parliament and EU Council reached a provisional agreement on 18 December 2022 on amending the existing EU legislation in this area: Directive 2003/87/EC (the “EU ETS Directive”), Decision (EU) 2015/1814 and Regulation (EU) 2015/757 (both together the “EU MRV”). A draft of the provisional agreement to amend this legislation was published on 8 February 2023.

The finalised revised legislative framework is expected formally to be adopted and published by the EU Parliament during the first quarter of 2023.

The current plan is to have a three year phase-in period:-

- staring at 40% of emissions in 2024, then

- increasing in scope from to 70% in 2025; and finally

- 100% in 2026.

Such limits would apply to all cargo and passenger ships above 5,000gt from 2024 and offshore ships above 5,000gt from 2027. As to the exact emissions covered, the scheme would first cover CO2 emissions only and then be widened to include methane and nitrous oxide from 2026. It may not stop there however as offshore ship and general cargo ships between 400 and 5,000 GT will also be required to report emissions and may be included in the EU ETS at a later stage.

Exactly what emission will be so limited?

First , all or 100% of emissions on voyages and port calls within the EU/EEA, and;

Second, 50% of emissions on voyages into or out of the EU/EEA.

To avoid evasive behaviour, container ships stopping in trans-shipment ports outside the EU/EEA but less than 300 nautical miles from an EU/EEA port, need to include 50% of the emissions for the voyage to that port as well, rather than only the short leg from the trans-shipment port. The EU has indicated that it will provide a list of trans-shipment ports.

Who will be responsible for complying with the legislation, and who will enforce it?

The draft legislation makes the shipping company (i.e. the owner, bareboat charterer and/or manager of a vessel, responsible for registering with an ‘administering authority’ and surrendering emissions allowances to a ‘competent authority’. Potential confusion here will hopefully be limited as the definition of the shipping company under the EU ETS Directive is the same as the definition of the “responsible person” under the ISM Code.

This means that under the current draft legislation it is the shipping company remains the ultimately responsible entity under both the EU ETS Directive and national laws implementing it. This means true notwithstanding the existence of any contractual rights that shipping companies may or may not have to be reimbursed by those, such as charterers, who purchase bunkers and direct their trading. Therefore, at the very least a review of such contractual arrangements with key service providers to ensure back-to-back indemnification should be conducted.

It is understood that the EU Commission intends to publish a list of shipping companies which will be subject to the EU ETS Directive. That list should also specify which particular administering authority they need to register with. This authority will likely be either:-

- the authority of the Member State in which they are domiciled; or,

- if domiciled, like UK shipowners outside the EU, the Member State their vessels visit most frequently.

Possible enforcement sanctions include fines and/r the power to expel all the vessels of offending shipping companies which fail to comply for two or more consecutive years from all EU ports. other than those of the vessel’s flag state. Thus representing a real commercial risk to future trade.

Cost implications for Shipping

Other than the obvious emissions allowance purchase costs, the set up and operation of the monitoring, reporting and verification processes, there are also potential enforcement fines for those that do not comply, All of which will undoubtably need to be passed down through pricing between related parities parties, including but not limited to charterers, cargo owners, ports and other handlers.

Any such costs recovery and related pricing changes will need the development of a trusted common basis of emissions performance data for voyage verification for all parties to manage their substantial tax cashflows. Of course this in turn will raise certain commercial confidentiality concerns.

Needless to say, the EU ETS will have an impact on a wide range of operations, costs and contractual agreements. The intention is to encourage shipping companies to reduce emissions. How they do so is left up to them, but it is anticipated it will through operational efficiencies, investments in low-carbon technologies and possible adopting alternative fuels. If so, then it may well lead to significant ship owner sponsored growth in the relate renewables R&D sector.

Where will the funds raised from the sale of credits and penalties go?

All revenues will be shared between:-

- the EU Innovation Fund, which is intended to invest in innovative low-carbon technologies and contributing to greenhouse gas reduction); and

- Member States, who we are told will be obliged to use their share of revenue for certain activities listed in the EU ETS Directive, such as sustainable transition to a low-carbon economy such as investment in developing energy-efficient maritime transport.

Undoubtably, as the scheme develops there will other developments and recipients.

So what should emitters do now?

First, do not ignore the EU ETS if you trade or intend to trade with the EU as these changes will affect your business. Compliance within the UK MVR will not necessarily ensure fully compliance with the EU ETS. In so far as they are not already in place, ensure you have systems, procedures and technology for accurate calculating, monitoring and reporting emissions. These of course need to be capable of change and development due to the intended and phased increasing scope of the scheme. For example, you should consult with your existing verifier to ensure that they can perform a similar role within the EU ETS;

Second, review existing key service provider arrangements and documentation. The intention here is to ensure both where such emission lability lies and second, if appropriate, where it can be passed or and/or indemnified against.

Third, consider with our key counterparties and stakeholders pricing strategies in the interim to cover the necessary scheme implementation costs.

Fourth, research and seek out new emission tracking, control and reduction technologies and processes with a view to assessing their worth for yours business.

Fifthly and finally, take advantages of economies of scale and reach out and seek advice and assistance from others (commercial, legal and regulatory) in the marine and shipping sector as they can undoubtably help you reduce the resulting operational and economic burdens.

You can contact Simon here.

To receive all the latest insights from gunnercooke to your inbox, sign up below