- People

- Expertise

Our expertise

We are a team of more than 500 professionals, with the depth of experience which makes us genuine experts in our fields. Together, gunnercooke’s people have strength across just about every corporate discipline and sector. We provide legal, commercial and strategic advice that delivers real value to the clients we work with, which span from multinational enterprises through to unicorns and non-for-profit organisations. Our breadth of expertise covers some of the most interesting and important emerging disciplines, from ESG and charity law, to blockchain and competition.

Search by practice areaDispute ResolutionDispute Resolution OverviewMeet the Dispute Resolution TeamIntellectual Property DisputesFinancial Services & FinTech OverviewProceeds of CrimeEmployment TribunalTax InvestigationProperty Dispute ResolutionInsolvency DisputesMediationCivil Fraud & Asset TracingHealth & SafetyBusiness Crime & InvestigationsLitigation & ArbitrationInternational Arbitration - International

International Offices

gunnercooke has 12 offices globally including the UK, Scotland, US, Germany and CEE, with further plans for growth in the coming years. These offices enhance the existing in-house capability of our dedicated international teams and dual-qualified experts that cover China and Hong Kong, Spain, France, Italy, Brazil and Portugal. Our team has experience working across 101 different countries, speaking 30 languages and are dual-qualified in 15 jurisdictions. Our expertise means we can offer large teams to carry out complex cross-border matters for major international clients.

- Our story

Our story

gunnercooke is the fastest growing corporate law firm in the UK, now making its mark globally. We comprise a rapidly growing number of experts spanning legal and other disciplines. Clients benefit from flexible options on fees to suit their needs, access to a wider network of senior experts throughout the relationship, and legal advice which is complemented by an understanding of the commercial aspects of running a business.

- Reading Room

- News & Insights

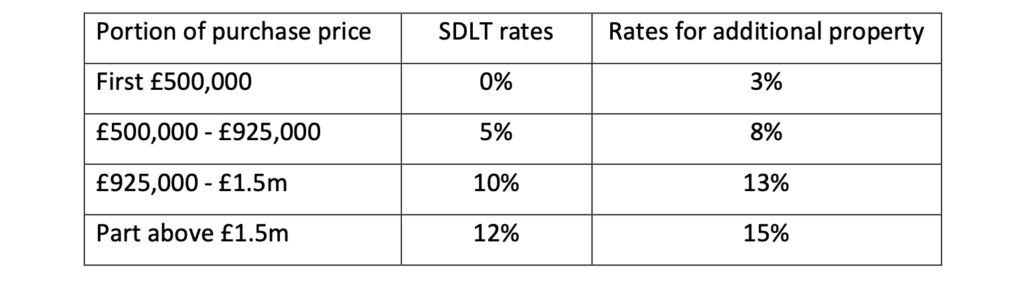

All purchasers of residential property in England and Northern Ireland will benefit from a reduction in SDLT for transactions that complete on or after 8 July 2020 and before 1 April 2021. The threshold of the nil rate band is being raised from £125,000 to £500,000, so now any purchase of a home up to £500,000 will not attract any duty.

The benefit of the increased nil rate band also applies to purchases for more than £500,000, so a purchase of a home for £700,000, will result in SDLT of £10,000, with duty at the rate of 5% being payable on the £200,000 portion of the purchase price above the £500,000 nil rate band threshold. A buyer of a home for £500,000 or more will now save £15,000.

First-time buyers relief which applies to the purchase of a first home for not more than £500,000, and gives exemption on the first £300,000 and a 5% rate of duty on the remainder, is now less generous than the new measure, and therefore First time buyers relief is replaced by this new temporary measure.

Where the residential property being purchased is an additional property, such as a second home or a purchase by a buy to let landlord, the supplemental 3% charge will apply to the new bands.

Here is a summary of the new measures:

Leases granted at a premium will also benefit from the increased nil rate band, as will the net present value of the rent over the term of the lease.

If you have any questions on these temporary reduced rates of SDLT please give Tax Partner, Julian Moran, a call on 07500 162 767.